UK

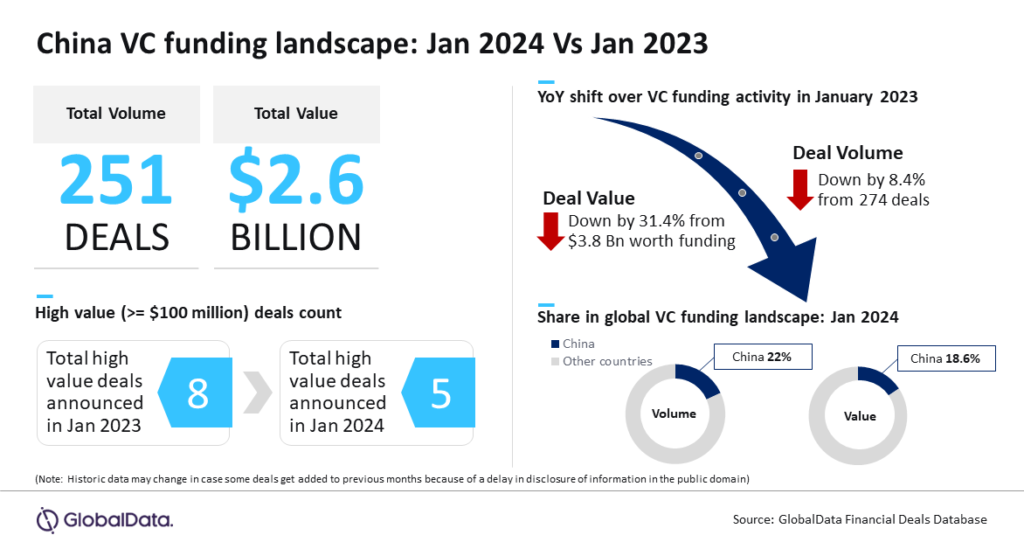

China witnessed the announcement of a total of 251 venture capital (VC) funding deals during January 2024 while the disclosed funding value of these deals stood at $2.6 billion. This represents a year-on-year (YoY) decline of 8.4% in terms of volume and 31.4% in terms of value, according to GlobalData, a leading data and analytics company.

According to an analysis of GlobalData’s Deals Database, a total of 274 VC deals with disclosed funding value of $3.8 billion were announced in China during January 2023.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Although China experienced subdued funding activity but the impact when seen in comparison with other key global markets seems relatively lesser highlighting relative resilience showcased by the country.”

For instance, key markets such as the US, the UK and India saw VC deal volume fall by 61.2%, 40.2% and 30.0%, respectively, in January 2024 compared to January 2023 while the decline in terms of value for these markets stood at 37%, 41.3% and 50.3%, respectively.

Bose adds: “It is noteworthy that China, apart from being the top APAC market, is also a key global market for VC funding activity and stands just next to the US in terms of both deal volume and value.”

China accounted for 22% share of the total number of VC funding deals announced globally during January 2024 while its share of the disclosed deal value stood at 18.6%.

Some of the notable VC funding deals announced in China during January 2024 include $210.8 million worth of funding raised by Qiyuan Core Power Technology, $162 million secured by Ji Xing Pharma and $100 million worth of funding raised by Chunqing Technology.

Bose concludes: “China’s relative resilience in the venture capital market underscores its enduring appeal and position as a key player on the global stage. Despite challenges, the country continues to attract significant investment, reflecting confidence in its innovation ecosystem and long-term growth prospects.”

Source: GlobalData